Your Guide to California Energy-Efficient Home Incentives in 2024

California ranks first in the nation for its solar power generation, thanks in large part to the robust incentives, tax credits, and rebates available to its residents. Regardless of where you live in California, there are a few solar incentives and savings benefits for you. Keep reading to learn how to get the most out of your investment in clean energy.

Comfortably CA

Comfortably CA is a statewide energy efficiency program serving HVAC distributors with incentives for specified high-efficiency residential and commercial heating and cooling equipment. The program offers incentives to distributors and retailers for selling high-efficiency HVAC equipment and provides no-cost training to contractors and technicians. Together, we’re helping California feel good, while participating businesses "outcomfort" the competition.

| Save up to $200+ per ton for eligible Residential Split System Heat Pump |

Who Can Apply: Contractors

Building Type: Multi-family, Single-family

Energy Efficient Home Improvement Tax Credit - 25C (Federal Tax Credit)

The Energy Efficient Home Improvement tax credit allows homeowners to claim a 30% tax credit (with annual limits that vary by service) on qualifying energy efficiency home improvements.

Who Can Apply: Homeowners, Renters

Building Type: Multi-family, Single-family

Federal Solar Tax Credit

Installing a home solar system is one of the best ways to reduce your carbon footprint and save money on your energy bills. If you’re thinking about going solar, the Inflation Reduction Act solar panel tax credit can make your installation more affordable.

The solar tax credit in 2024 is worth 30% of your total solar installation costs—if you spend $15,000 on your solar installation, you can reduce your federal tax liability by $4,500! It will be available from 2022 until 2032 and covers all types of solar installations, including rooftop solar, off-grid solar, and solar battery storage.

Who Can Apply: California Residents

Disadvantaged Communities Single-Family Affordable Solar Homes (DAC-SASH) Program

To increase the adoption of renewable energy in disadvantaged communities, California created the Disadvantaged Communities Single-family Affordable Solar Homes. Also known as DAC-SASH, this state program provides qualified homeowners with fixed, upfront, capacity-based incentives that can help offset the cost of a solar energy system.

The DAC-SASH program offers up to $3 per watt to eligible homeowners.

Solar Energy System Property Tax Exclusion

In California, people who install a solar- or wind-powered device to produce energy for their residence or place of business are entitled to an exemption for the amount of value the device contributes to their property. This essentially means anyone who installs solar panels or other solar-powered devices on their property is exempt from paying property taxes equivalent to the property value increase as a result of adding said system until 2025.

It’s a win-win: your solar system could increase the value of your home and you don’t have to pay property taxes on it. This incentive is a great benefit, especially for people who require a larger system to offset their electricity usage.

Net Metering Programs

Customers who install solar panels on their homes are eligible for the state of California’s net metering program. Net energy metering (NEM) is a billing mechanism where utility companies provide credits to homeowners for the extra electricity their solar panels generate and add to the electricity grid.

In the past, this was one of the best California solar incentives available. Unfortunately, the recent changes of NEM 3.0 have removed some of the benefits of net metering. But while the new rules are not as generous for a basic solar energy system, by adding a battery, you can still reduce (or even erase) your utility bill through this program.

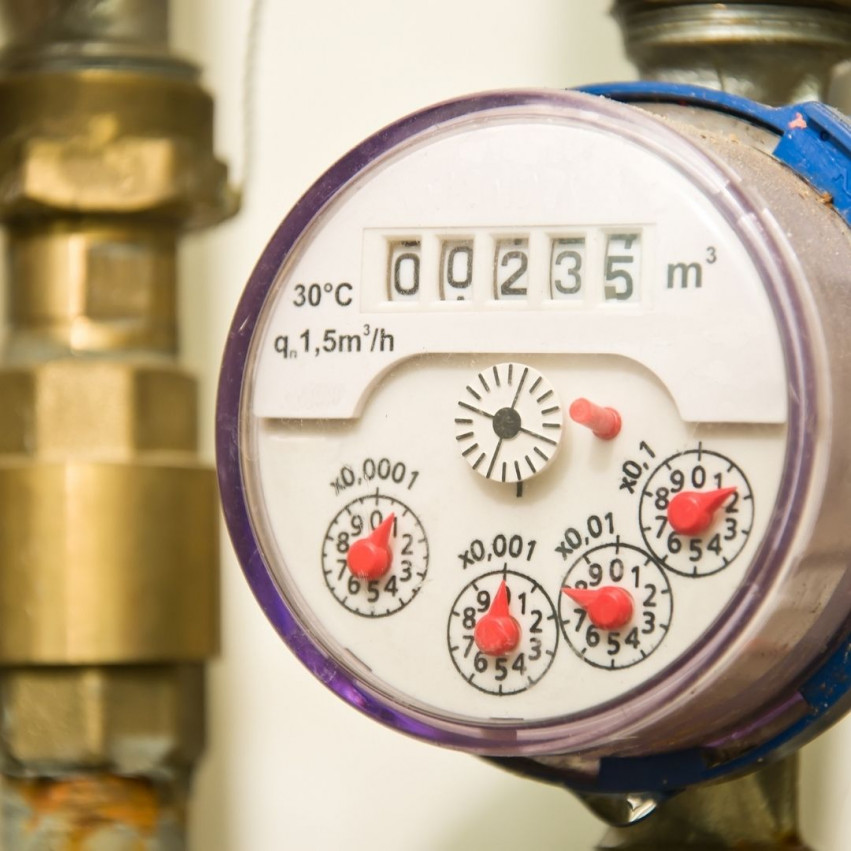

Waterscape Rebate Program

When you harvest and reuse your rainwater for irrigation, you can keep your outdoor space looking fantastic — and save money doing it. There are plenty of beautiful, efficient ways to save rainwater. Rebates depend on the rain-saving options you choose - rain-saving to yard, garden, containers, gutters.

California Energy-Smart Homes

The California Energy-Smart Homes Program is a residential new construction and alterations program that provides incentives to adopt advanced energy measures and transition to all-electric construction. The program is an all-in-one solution that offers incentives for single family, duplex, townhome, multifamily low-rise, alterations, and accessory dwelling units.

The Energy-Smart Homes Program is available to utility customers in the Pacific Gas and Electric Company (PG&E®), San Diego Gas & Electric Company (SDG&E®), and Southern California Edison Company (SCE®) electric territories.

| Save $5,500 per housing unit - Rebate on Whole Home (Single-family) |

| Save $3,550 per housing unit - Rebate on Whole Home (Multi-family) |

Who Can Apply: Contractors, Homeowners

Building Type: Multi-family, Single-family

.png?w=851)

Golden State Rebates

Golden State Rebates provides instant rebates on energy-efficient products to help Californians save energy and live comfortably. Customers receive these rebates through coupons they can redeem in store or online at participating retailers.

| Save up to $900 per unit – Rebate on Heat Pump Water Heater |

| Save $500 per unit - Rebate on Heat Pump Water Heater |

| Save $40 - $75 per unit - Rebate on Smart Thermostat |

Who Can Apply: Homeowners, Renters

Building Type: Multi-family, Single-family

San Diego Green Building Council

The Electric Home Cooktop Program is designed to allow anyone who is interested in experiencing cooking with an induction cooktop to do so, regardless of their experience level. With the program, anyone can check out a Duxtop 9100mc induction cooktop for at least 3 weeks, free of charge, to gain first hand experience of the benefits associated with cooking with induction cooktops.

Who Can Apply: Contractors, Homeowners, Renters

Building Type: Single-family

TECH Clean California Rebates

TECH Clean California rewards contractors for recommending and installing heat pumps in existing single-family and multifamily California homes.

| Save $3,100 - $7,300 per unit - Residential Unitary, Single Family Heat Pump Water Heater |

| Save $1000 per unit - Rebate on Heat Pumps, Ducted (central air, HVAC), Heat Pumps, Ductless (mini-split) |

| Save $4,185 - $10,385 per unit - Rebate on Heat Pump Water Heater, Single Family Unitary, Equity |

Who Can Apply: Contractors

Building Type: Single-family

Inflation Reduction Act Residential Energy Rebate Programs

The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits: Home Efficiency Rebates (HOMES) to fund whole house energy efficiency retrofits and the Home Electrification and Appliance Rebates (HEEHRA) to help low-moderate income households “go electric” through qualified appliance rebates.

Energy Savings Assistance

Providing no-cost weatherization services to consumers who meet the CARE income limits.

Services Provided

The Energy Savings Assistance Program (ESA) services provided include:

- Attic insulation

- Energy-efficient refrigerators

- Energy-efficient furnaces

- Weatherstripping

- Caulking

- Low-flow showerheads

- Water heater blankets

- Door and building envelope repairs which reduce air infiltration

Self-Generation Incentive Program (SGIP)

The California Public Utilities Commission’s Self-Generation Incentive Program (SGIP) offers rebates to residents for installing a solar battery along with the solar panel. The rebate amount varies depending on battery storage capacity and the local utility company.

PACE financing for solar panels

Property Assessed Clean Energy programs provide financing for solar installations that allows residents to pay back loans for solar panels with their property taxes. While commercial PACE loans are common throughout the US, only three states -- California, Florida and Missouri -- offer residential PACE programs.

Unlike mortgage loans, PACE loans usually require no down payment or monthly payments. Instead, borrowed money is repaid through homeowners' property tax bills over a term of 10 to 30 years. A lien is placed on your home until the loan is fully paid off, which makes selling your home more complicated. Some lenders may not want to provide a mortgage for a home with an attached PACE lien.

California currently has four state-licensed PACE program administrators:

- FortiFi Financial

- Home Run Financing (formerly PACE Funding Group)

- Renew Financial Group

- Ygrene Energy Fund

Local communities may provide PACE-style financing of their own. The Sonoma County Energy Independence Program functions similarly to state-licensed PACE programs, letting participants pay back solar installations via their property tax bills over 10- or 20-year terms at 7.49% interest.

San Diego Green Building Incentive Program

The city of San Diego will waive building permit fees and plan check fees for the installation of residential solar panels.

SoCalGas Solar Thermal Water Heating System Rebate

SoCalGas customers in central and Southern California can get a rebate of $2,500 to $4,000 on qualifying solar water heaters. Your system must have a Solar Uniform Energy Factor of 1.8 or higher, and you'll need to install a new Energy Star-certified water heater along with your solar installation.

Solar System Property Tax Exemption

California currently excludes solar panel installations when assessing the value of your property. That means solar panels, though they do increase your home’s value, will not increase your property taxes. This exclusion will expire on Jan 1, 2025.

Miramar Landfill and Greenery

City of San Diego residents can self-load up to 2 cubic yards of compost or 4-inch mulch, at no cost, at the City of San Diego Miramar Greenery. These products are available to residents up to one time per day on an ongoing basis, during Greenery operating hours.

.png?w=851)